- April 21, 2024 3:00 am

- Australia

Unlock Growth in 2024 – Outsource Accounting Services Now For Your Business. The current business environment is extremely changeable where the market is never balanced and different novelty is exposed every day; yet small-to-medium enterprises (SMEs) have a complicated position. That being the only factor which makes clear the chances of the success of these countries is Accounting Outsourcing on the other hand.

On the other hand bigger SMEs where once SMEs became big, the costs of Bookkeeping Services and Payroll Processing as well as their time and additional resources needed, are very high and may interfere with the main operations. This is where outsource accounting services are of great importance as they need to bring in accounting professionals and resources that will ensure those financial procedures as required to run in a smooth manner and abide by the current laws

Understanding Outsource Accounting Services

While outsourcing is a decision taken by companies to give the responsibility of accounting to the third-party vendors, it is a strategic decision which allows a company to focus on its core competencies. These firms that are equally specialised and have a combination of professionals competent in financial management become the counterparts to SMEs in handling their financial tasks. The main objectives of outsource accounting cover increased efficiency in operations, lowering costs, rule compliance, and making business owners concentrate on their core competencies.

The Major Deliverable for Offshoring Accounting Services

Bookkeeping Services

Bookkeeping is the basis of bookkeeping and thereby other bookkeeping. Also, it’s the source of maintaining the list of financial operations by the business. This incorporates careful disclosure in all money changing processes, including earnings, expenditure, assets, and liabilities. Outsource accounting services convey to SMEs about using the bookkeeping services of pro bookkeepers which are based on the advanced software with different accounting tools that update the records at the end of business time.

Outsourcing is more than adding numbers together and sending them back as data – it is something bigger than that. To sum up, various jobs are involved such as financial report generation, bank reconciliation, and billing and invoicing and also the inventory monitoring. Entrusting your outsourced bookkeeping to an experienced service provider, gives your small enterprise (SME) the power to check that all the financial records are in line with the industry standards and all statutory reporting obligations are properly done.

Payroll Processing

Payroll Processing has an ever-changing aspect, which is being extremely detailed in tax procedures and compliance with the latest tax legal regulations. As the number of employees increases, SMEs frequently encounter the problem of government, which requires a great fuss. The most essential aspect of this scenario is that outsourcing payroll services is an invaluable benefit.

The outsourced payroll providers have specialization in the payroll computation that include the workers’ wage, taxes, benefits and deductions. They can be vetted to be handling the crucial things such as generating payslips, managing employee benefits and filing payroll taxes. The outsourcing of this function allows SMEs to miss the costly errors, reduce the risk of non-compliance, and employ workers on time with the accurate payments.

One of the key decisions after When to Outsource Accounting Processes is Choosing the Right Partner.

In order to maximize the benefits of this collaboration, SME must thus assign a suitable outsourced accountant. To help you with this decision, keep the following important aspects in mind:

Do research on the reputation, years of experience, and overall performance of the organization that is likely to outsource the work. Reviews and testimonials make it possible to rely on the consumer’s experience.

Range of Services:

Habitat requires that you get your professional accounting services outside from providers who offer all means to fulfill the demands they are assigned to.

Technology and Security:

Request for the information of the firm’s kind of accounting software and security system, which will protect your data from fraudsters.

Customization:

Search for a provider who can customize the services to your business’ specific needs. From learners of different academic levels to skilled professionals, everyone can benefit from this interactive platform.

Cost Structure:

Conduct the overhead cost breakdown of different outsourcing firms and find an outsourcing formula that will be affordable for you.

Communication and Support:

Successful communication and cooperation need to serve as unusual qualities if a partner is an outsourcing partner. Provide with them the accessible and responsive services.

If you’re unsure about how to do your accounting tasks, making profit, and freeing up business owner’s time for strategic projects, we are the ideal partner for you.

Is the accounting of income throughout the business and the payroll resulting in you intimating from your key business activities?

Now is a really a perfect time for you to take control of your business by signing up for an accounting outsourcing firm.

We are JAKS, the appropriate source of accounting outsourcing services, boasting a solid reputation and vast experiences dating back to years and an employ of more than 140 employees upbeat to meet your particular needs with the best tools and skills. From the options of security services we have available, to the advantages of various delivery and pickup mechanisms, our services are all tailored and customised to suit our clients’ availability.

Feel free to reach us at Ind: +91 95393 27777, Aus: +61 40255 4052, UK: +44 20719 39817, Middle-East: +971 54 728 6743 or email us at cokadmin@jaksllp.in to have an expert talk about your On top of everything, you will be certain of your financial targets being reached when the right time comes.

Please click www.jaks365.com today to get to know us better. Partner with us now.

Accounting services outsourcing could benefit small and medium-sized businesses (SMEs). This can indicate the boundary between corporate success and failure. Delegating these financial matters to professionals who understand the likelihood of high levels of efficiency, compliance, and cost reduction is essential for SMEs to succeed. Now that the burden of accounting has been removed, business owners can concentrate entirely on growing their companies and finding long-term success in the security industry. One useful tool that assists SMEs in growing their businesses is outsourcing their accounting.

Location

Related Ads

Company Incorporation

- 2 weeks ago

- Rohtak City, Haryana, India

- 21 Views

ITR Filling Services in Durg City

- 2 months ago

- Durg City, Chhattisgarh, India

- 20 Views

Reliable FSSAI Registration Services in Laxmi Nagar New Delhi

- 2 months ago

- Laxmi Nagar, Delhi, India

- 21 Views

Income Tax E Filing

- 2 months ago

- Delhi Cantonment, Delhi, India

- 25 Views

Account Management Services in Bangladesh

- 3 months ago

- Bangladesh

- 39 Views

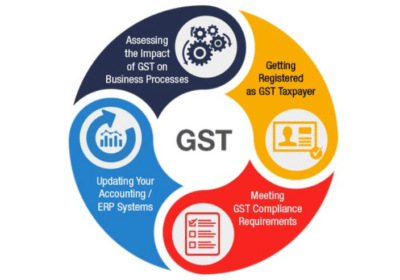

New GST Registration

- 4 months ago

- Barabanki City, Uttar Pradesh, India

- 28 Views

New Company Registrations – Step by Step Procedure

- 4 months ago

- Patna City, Bihar, India

- 34 Views

Microfinance Audit and Compliance

- 4 months ago

- Patna City, Bihar, India

- 30 Views

Microfinance Company Registration

- 4 months ago

- Patna City, Bihar, India

- 31 Views

GST Registration in India | Kcorptax

- 6 months ago

- Noida City, Uttar Pradesh, India

- 62 Views

Economic Substance Regulations Services in UAE | Farahat and Co.

- 6 months ago

- UAE

- 63 Views

Tax Obligations Tailored For Non-Profit Organizations in Pakistan | Softax

- 7 months ago

- Pakistan

- 47 Views

New GST Registration Services in Pune | Business License

- 8 months ago

- Pune City, Maharashtra, India

- 51 Views

Online Tax Consulting Services | DigiTaxFilings

- 8 months ago

- Hyderabad - Ameerpet, Telangana, India

- 47 Views

Corporate Tax Preparation in UAE | Farahat and Co.

- 8 months ago

- UAE

- 61 Views

Corporate Tax Consultation in UAE | Farahat Co

- 9 months ago

- UAE

- 57 Views

External Audit Services in Dubai | Farahat and Co

- 9 months ago

- UAE

- 72 Views

Tax Filings and Corporate Registration Services in Bangalore

- 9 months ago

- Bengaluru - Bannerghatta Road, Karnataka, India

- 58 Views

Everything You Must Know About Changing Your State Residency When Moving Abroad

- 9 months ago

- Ahmadabad City, Gujarat, India

- 74 Views

ITR Filling Service in Durg Chhattisgarh Only ₹299/-

- 10 months ago

- Durg City, Chhattisgarh, India

- 100 Views

DoorStep BookKeepers Services in Chandigarh

- 10 months ago

- Chandigarh City, Chandigarh, India

- 67 Views

Income Tax Return Preparation Andra Pradesh | Easy Tax Filers

- 10 months ago

- Rajahmundry, Andhra Pradesh, India

- 48 Views

Part Time Accountant in Habra

- 10 months ago

- Habra - II, West Bengal, India

- 55 Views

Accounts and Taxes Advisory Services in Kolkata | Tax and Taxation

- 10 months ago

- Kolkata - Ballygunge, West Bengal, India

- 64 Views

Part Time Accounting Services in Indore

- 10 months ago

- Indore City, Madhya Pradesh, India

- 67 Views

ITR-4 Return Filing in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 70 Views

ITR-5 Return Filing in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 69 Views

Form 16 Filing in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 84 Views

TDS Filing Service in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 79 Views

Businesses Tax Filings in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 68 Views

Best Tax Consultants Services in Hyderabad | Sri Balaji Tax Services

- 11 months ago

- Hyderabad - Nayapul, Telangana, India

- 74 Views

Hire an Accountant at Reliable Prices | Invedus

- 12 months ago

- Washington, USA

- 59 Views

Top Tax Consultants in Mumbai | Jordensky

- 12 months ago

- Mumbai - Bhandup, Maharashtra, India

- 64 Views

Outsourced Accounts Payable Services India | Avidity LLP

- 12 months ago

- Ahmadabad City, Gujarat, India

- 48 Views

GST Registration with GSTN Registration

- 12 months ago

- Noida City, Uttar Pradesh, India

- 74 Views

Taxation Outsourcing Services in USA | Avidity LLP

- 12 months ago

- Ahmadabad City, Gujarat, India

- 51 Views

Outsource Bookkeeping Services to India | Avidity

- 1 year ago

- Ahmadabad City, Gujarat, India

- 56 Views

Government Grants in The UK | Counting King

- 1 year ago

- UK

- 63 Views

Outsourced Accounting Services in India | Avidity

- 1 year ago

- Ahmadabad City, Gujarat, India

- 60 Views

Risk Advisory Services in Delhi, India | DPNC Global

- 1 year ago

- Defence Colony, Delhi, India

- 84 Views

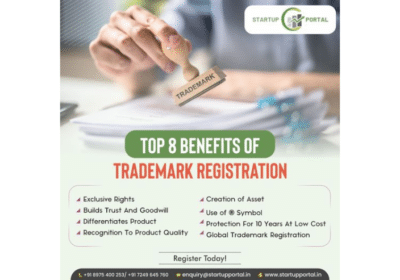

Trademark Registrations in Pune | Startupportal.in

- 1 year ago

- Pune City, Maharashtra, India

- 60 Views

GST Consultants in Mumbai | SalesTaxIndia.com

- 1 year ago

- Mumbai - Fort, Maharashtra, India

- 67 Views

Become Active Filer and Come To FBR ACTIVE TAXPAYER LIST(ATL) | GMW Solution

- 1 year ago

- Pakistan

- 70 Views

Best Income Tax Filing Consultants in Hyderabad | Akshara Finserv

- 1 year ago

- Hyderabad - Himayatnagar, Telangana, India

- 238 Views

Tax & Accounting Services in Jaipur

- 1 year ago

- Jaipur City, Rajasthan, India

- 112 Views

Types of Assessment under Income Tax Act, 1961

- 1 year ago

- Chandni Chowk, Delhi, India

- 130 Views

Get Your Gem Registration at 999/-

- 1 year ago

- Dehradun, Uttarakhand, India

- 143 Views

Apply GST Registration for Your Business

- 1 year ago

- Ghaziabad City, Uttar Pradesh, India

- 113 Views

Digital Signature Certificate | Oish Enterprise

- 1 year ago

- Kolkata - Barabazar, West Bengal, India

- 169 Views

TDS Return Service Provider in India | Taxser

- 1 year ago

- Sirsa City, Haryana, India

- 103 Views

Top Corporate Tax Consultation in UAE

- 1 year ago

- UAE

- 123 Views

Best External Audit Services in Dubai

- 1 year ago

- UAE

- 94 Views

GST Registration in Erode | ShopLegal

- 1 year ago

- Erode City, Tamil Nadu, India

- 138 Views

List of Top Vat Advisors in Dubai

- 1 year ago

- UAE

- 122 Views

Top VAT Services in Dubai, UAE | Big Bracket UAE

- 1 year ago

- UAE

- 138 Views

Best US Accounting Services in Coimbatore | GKM

- 1 year ago

- Coimbatore North, Tamil Nadu, India

- 153 Views

Best CA Firm in Delhi | Sunil K. Khanna & Co.

- 1 year ago

- Nehru Place, Delhi, India

- 134 Views

Top Annual Audit Reporting Service in Oman

- 2 years ago

- Oman

- 138 Views

Top Bookkeeping Services in Coimbatore | GKM

- 2 years ago

- Coimbatore North, Tamil Nadu, India

- 199 Views

Best Tax Return Filing Consultant in Coimbatore | GKM

- 2 years ago

- Coimbatore North, Tamil Nadu, India

- 135 Views

The Myths and Realities of 80G Tax Exemption | NGO Registration

- 2 years ago

- Patparganj, Delhi, India

- 119 Views

Best Chartered Accountant in Bikaner, RJ | Abhay Sharma & Co

- 2 years ago

- Bikaner City, Rajasthan

- 207 Views

Best Chartered Accountants in Asansol, WB | TAXSAMAJ

- 2 years ago

- Asansol, West Bengal

- 139 Views

Best CA Firm in Bhubaneswar | K SWAIN & CO

- 2 years ago

- Bhubaneswar (M.Corp.), Odisha

- 119 Views

Best CA Firm in Delhi | PRYD & Associates

- 2 years ago

- Chanakya Puri, Delhi

- 136 Views

Best Chartered Accountant In Pune | SKPN & ASSOCIATES

- 2 years ago

- Pune City, Maharashtra

- 193 Views

Accounting and Tax Consulting Services – Tax Creche

- 2 years ago

- Sas Nagar (Mohali), Punjab

- 145 Views

Income Tax Consultant in Pune | Finance Advisor in Pune | SKPN

- 2 years ago

- Pune City, Maharashtra

- 194 Views

Jagdamba Accountancy – Panipat City, Haryana

- 2 years ago

- Panipat City, Haryana

- 153 Views

Trust Registration / Society Registration / NGO Consultancy

- 2 years ago

- Preet Vihar, Delhi

- 201 Views

80G Registration – Section 80g Consultancy Services

- 2 years ago

- Patparganj, Delhi

- 266 Views

APNA SUVIDHA KENDRA

- 2 years ago

- Bhagawangola - I, West Bengal

- 306 Views

Income Tax E-Filing Services in Pune – Salary/Business

- 2 years ago

- Pune City, Maharashtra

- 201 Views

Business Income Tax Return Filing Service

- 2 years ago

- Ahmadabad City, Gujarat

- 357 Views

You must be logged in to post a review.