- June 30, 2023 3:53 pm

- Chennai - Medavakkam, Tamil Nadu, India

Form 16 Filing in Chennai | Intellecto Filings

Form 16 is an important document for salaried individuals in Chennai when it comes to income tax filing.

It serves as a certificate of tax deduction and provides crucial information for filing income tax returns.

This article will explain the significance of Form 16 filing in Chennai and guide employers and employees through the compliance process.

Understanding Form 16:

Form 16 is issued by employers to employees, providing details of the salary earned during the financial year and the tax deductions made on it.

Part A includes employer and employee details such as name, PAN (Permanent Account Number), and TAN (Tax Deduction and Collection Account Number) of the employer.

Part B provides an overview of the salary structure, allowances, deductions, and net taxable income.

Importance of Form 16 Filing:

Form 16 holds importance for both employers and employees:

- Employee’s Perspective: Form 16 acts as evidence of the salary received and the taxes deducted at source. It helps employees accurately file their income tax returns and claim refunds or exemptions they are eligible for.

- Employer’s Perspective: Issuing Form 16 is a legal obligation for employers. It promotes transparency and trust, ensures compliance with tax regulations, and helps avoid penalties.

Responsibilities of Employers:

Employers in Chennai have certain responsibilities related to Form 16 filing:

- Deduction and Payment of Taxes: Employers must accurately calculate and deduct taxes from employees’ salaries based on applicable tax slabs.

- Issuing Form 16: Employers need to issue Form 16 to employees on or before the due date, typically on or before 15th June of the subsequent financial year.

- Filing TDS Returns: Employers must file quarterly TDS returns (Form 24Q) with the Income Tax Department, providing details of tax deductions made from employees’ salaries.

Employee’s Role in Form 16 Filing:

Employees should actively participate in the Form 16 filing process:

- Verification: Employees must verify the details mentioned in Form 16, ensuring accuracy and resolving any discrepancies with their employers.

- Income Tax Return Filing: Form 16 serves as a reference for employees when filing their income tax returns. Employees should use the information provided in Part B to accurately report their income and claim deductions or exemptions.

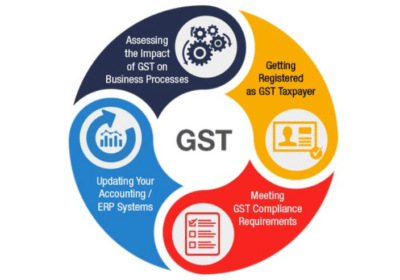

Best GST return filing in Chennai

Best Personal Tax Filing In Chennai

Best Businesses operating in Chennai

Best TDS Filing Service in Chennai

Best Form 16 Filing In Chennai

Seller Information

Please login to view the seller information.

Business Hours

| Open | Close | ||

|---|---|---|---|

| Monday | Open (24 Hours) | ||

| Tuesday | Open (24 Hours) | ||

| Wednesday | Open (24 Hours) | ||

| Thursday | Open (24 Hours) | ||

| Friday | Open (24 Hours) | ||

| Saturday | Open Today (24 Hours) | ||

| Sunday | Open (24 Hours) | ||

Location

Related Ads

Company Incorporation

- 1 week ago

- Rohtak City, Haryana, India

- 18 Views

ITR Filling Services in Durg City

- 1 month ago

- Durg City, Chhattisgarh, India

- 19 Views

Reliable FSSAI Registration Services in Laxmi Nagar New Delhi

- 2 months ago

- Laxmi Nagar, Delhi, India

- 19 Views

Income Tax E Filing

- 2 months ago

- Delhi Cantonment, Delhi, India

- 23 Views

Account Management Services in Bangladesh

- 3 months ago

- Bangladesh

- 36 Views

New GST Registration

- 4 months ago

- Barabanki City, Uttar Pradesh, India

- 25 Views

New Company Registrations – Step by Step Procedure

- 4 months ago

- Patna City, Bihar, India

- 31 Views

Microfinance Audit and Compliance

- 4 months ago

- Patna City, Bihar, India

- 28 Views

Microfinance Company Registration

- 4 months ago

- Patna City, Bihar, India

- 30 Views

GST Registration in India | Kcorptax

- 5 months ago

- Noida City, Uttar Pradesh, India

- 61 Views

Economic Substance Regulations Services in UAE | Farahat and Co.

- 6 months ago

- UAE

- 60 Views

Tax Obligations Tailored For Non-Profit Organizations in Pakistan | Softax

- 7 months ago

- Pakistan

- 45 Views

New GST Registration Services in Pune | Business License

- 8 months ago

- Pune City, Maharashtra, India

- 50 Views

Online Tax Consulting Services | DigiTaxFilings

- 8 months ago

- Hyderabad - Ameerpet, Telangana, India

- 47 Views

Corporate Tax Preparation in UAE | Farahat and Co.

- 8 months ago

- UAE

- 60 Views

Corporate Tax Consultation in UAE | Farahat Co

- 9 months ago

- UAE

- 57 Views

External Audit Services in Dubai | Farahat and Co

- 9 months ago

- UAE

- 70 Views

Tax Filings and Corporate Registration Services in Bangalore

- 9 months ago

- Bengaluru - Bannerghatta Road, Karnataka, India

- 57 Views

Everything You Must Know About Changing Your State Residency When Moving Abroad

- 9 months ago

- Ahmadabad City, Gujarat, India

- 73 Views

ITR Filling Service in Durg Chhattisgarh Only ₹299/-

- 9 months ago

- Durg City, Chhattisgarh, India

- 100 Views

DoorStep BookKeepers Services in Chandigarh

- 9 months ago

- Chandigarh City, Chandigarh, India

- 66 Views

Income Tax Return Preparation Andra Pradesh | Easy Tax Filers

- 9 months ago

- Rajahmundry, Andhra Pradesh, India

- 46 Views

Part Time Accountant in Habra

- 10 months ago

- Habra - II, West Bengal, India

- 53 Views

Accounts and Taxes Advisory Services in Kolkata | Tax and Taxation

- 10 months ago

- Kolkata - Ballygunge, West Bengal, India

- 62 Views

Part Time Accounting Services in Indore

- 10 months ago

- Indore City, Madhya Pradesh, India

- 67 Views

ITR-4 Return Filing in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 68 Views

ITR-5 Return Filing in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 68 Views

TDS Filing Service in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 79 Views

Businesses Tax Filings in Chennai | Intellecto Filings

- 10 months ago

- Chennai - Medavakkam, Tamil Nadu, India

- 66 Views

Best Tax Consultants Services in Hyderabad | Sri Balaji Tax Services

- 11 months ago

- Hyderabad - Nayapul, Telangana, India

- 73 Views

Hire an Accountant at Reliable Prices | Invedus

- 11 months ago

- Washington, USA

- 59 Views

Top Tax Consultants in Mumbai | Jordensky

- 12 months ago

- Mumbai - Bhandup, Maharashtra, India

- 64 Views

Outsourced Accounts Payable Services India | Avidity LLP

- 12 months ago

- Ahmadabad City, Gujarat, India

- 48 Views

GST Registration with GSTN Registration

- 12 months ago

- Noida City, Uttar Pradesh, India

- 73 Views

Taxation Outsourcing Services in USA | Avidity LLP

- 12 months ago

- Ahmadabad City, Gujarat, India

- 50 Views

Outsource Bookkeeping Services to India | Avidity

- 12 months ago

- Ahmadabad City, Gujarat, India

- 56 Views

Government Grants in The UK | Counting King

- 12 months ago

- UK

- 63 Views

Outsourced Accounting Services in India | Avidity

- 1 year ago

- Ahmadabad City, Gujarat, India

- 59 Views

Risk Advisory Services in Delhi, India | DPNC Global

- 1 year ago

- Defence Colony, Delhi, India

- 82 Views

Trademark Registrations in Pune | Startupportal.in

- 1 year ago

- Pune City, Maharashtra, India

- 57 Views

GST Consultants in Mumbai | SalesTaxIndia.com

- 1 year ago

- Mumbai - Fort, Maharashtra, India

- 67 Views

Become Active Filer and Come To FBR ACTIVE TAXPAYER LIST(ATL) | GMW Solution

- 1 year ago

- Pakistan

- 68 Views

Best Income Tax Filing Consultants in Hyderabad | Akshara Finserv

- 1 year ago

- Hyderabad - Himayatnagar, Telangana, India

- 235 Views

Tax & Accounting Services in Jaipur

- 1 year ago

- Jaipur City, Rajasthan, India

- 112 Views

Types of Assessment under Income Tax Act, 1961

- 1 year ago

- Chandni Chowk, Delhi, India

- 129 Views

Get Your Gem Registration at 999/-

- 1 year ago

- Dehradun, Uttarakhand, India

- 142 Views

Apply GST Registration for Your Business

- 1 year ago

- Ghaziabad City, Uttar Pradesh, India

- 111 Views

Digital Signature Certificate | Oish Enterprise

- 1 year ago

- Kolkata - Barabazar, West Bengal, India

- 168 Views

TDS Return Service Provider in India | Taxser

- 1 year ago

- Sirsa City, Haryana, India

- 103 Views

Top Corporate Tax Consultation in UAE

- 1 year ago

- UAE

- 123 Views

Best External Audit Services in Dubai

- 1 year ago

- UAE

- 93 Views

GST Registration in Erode | ShopLegal

- 1 year ago

- Erode City, Tamil Nadu, India

- 138 Views

List of Top Vat Advisors in Dubai

- 1 year ago

- UAE

- 119 Views

Top VAT Services in Dubai, UAE | Big Bracket UAE

- 1 year ago

- UAE

- 138 Views

Best US Accounting Services in Coimbatore | GKM

- 1 year ago

- Coimbatore North, Tamil Nadu, India

- 152 Views

Best CA Firm in Delhi | Sunil K. Khanna & Co.

- 1 year ago

- Nehru Place, Delhi, India

- 134 Views

Top Annual Audit Reporting Service in Oman

- 1 year ago

- Oman

- 133 Views

Top Bookkeeping Services in Coimbatore | GKM

- 2 years ago

- Coimbatore North, Tamil Nadu, India

- 198 Views

Best Tax Return Filing Consultant in Coimbatore | GKM

- 2 years ago

- Coimbatore North, Tamil Nadu, India

- 133 Views

The Myths and Realities of 80G Tax Exemption | NGO Registration

- 2 years ago

- Patparganj, Delhi, India

- 117 Views

Best Chartered Accountant in Bikaner, RJ | Abhay Sharma & Co

- 2 years ago

- Bikaner City, Rajasthan

- 202 Views

Best Chartered Accountants in Asansol, WB | TAXSAMAJ

- 2 years ago

- Asansol, West Bengal

- 139 Views

Best CA Firm in Bhubaneswar | K SWAIN & CO

- 2 years ago

- Bhubaneswar (M.Corp.), Odisha

- 118 Views

Best CA Firm in Delhi | PRYD & Associates

- 2 years ago

- Chanakya Puri, Delhi

- 136 Views

Best Chartered Accountant In Pune | SKPN & ASSOCIATES

- 2 years ago

- Pune City, Maharashtra

- 192 Views

Accounting and Tax Consulting Services – Tax Creche

- 2 years ago

- Sas Nagar (Mohali), Punjab

- 142 Views

Income Tax Consultant in Pune | Finance Advisor in Pune | SKPN

- 2 years ago

- Pune City, Maharashtra

- 194 Views

Jagdamba Accountancy – Panipat City, Haryana

- 2 years ago

- Panipat City, Haryana

- 151 Views

Trust Registration / Society Registration / NGO Consultancy

- 2 years ago

- Preet Vihar, Delhi

- 201 Views

80G Registration – Section 80g Consultancy Services

- 2 years ago

- Patparganj, Delhi

- 266 Views

APNA SUVIDHA KENDRA

- 2 years ago

- Bhagawangola - I, West Bengal

- 306 Views

Income Tax E-Filing Services in Pune – Salary/Business

- 2 years ago

- Pune City, Maharashtra

- 201 Views

Business Income Tax Return Filing Service

- 2 years ago

- Ahmadabad City, Gujarat

- 357 Views

You must be logged in to post a review.