In a business landscape often fueled by profit-oriented goals, the process of Section 8 Company Registration stands as a guiding force for those dedicated to social causes.

Commonly known as non-profit or non-governmental organizations, Section 8 Companies focus on advancing art, science, commerce, education, research, social welfare, religion, charity, environmental protection, or any other charitable purpose.

This article seeks to serve as a thorough guide to Section 8 Company Registration, offering insights into the complexities of the registration process for individuals and entities entering the realm of social entrepreneurship.

Understanding Section 8 Company:

Governed by the Companies Act of 2013, a Section 8 Company distinguishes itself with its non-profit motive. Generated profits, if any, are earmarked for advancing objectives, with no dividends distributed to members. This legal structure is ideal for organizations committed to social welfare without the primary intent of financial gain.

Key Features of Section 8 Company:

- No Minimum Capital Requirement: Unlike other company structures, Section 8 Companies are not bound by a minimum authorized or paid-up capital. This flexibility allows founders to allocate resources towards their charitable objectives.

- Tax Exemptions: Section 8 Companies enjoy exemptions under the Income Tax Act, making them eligible for tax benefits. Donors supporting these organizations can also benefit from tax deductions, fostering an environment conducive to philanthropy.

- Limited Liability: Members of a Section 8 Company benefit from limited liability, safeguarding personal assets from the company’s debts. This encourages individuals to actively participate in social initiatives without excessive financial risk.

- Perpetual Succession: Section 8 Companies enjoy perpetual succession, ensuring continuity in pursuing charitable goals. Changes in membership or leadership do not impede the organization’s ability to fulfill its mission over the long term.

Section 8 Company Registration Process:

Now that the distinctive features are clear, let’s delve into the step-by-step process of registering a Section 8 Company:

- Name Approval: The journey begins with selecting a unique and meaningful name for the company, complying with guidelines set by the Ministry of Corporate Affairs (MCA) to avoid resemblance to existing company names.

- Digital Signature Certificate (DSC) and Director Identification Number (DIN): Obtaining a Digital Signature Certificate (DSC) is followed by acquiring a Director Identification Number (DIN) for all proposed directors. These are essential for filing documents with the MCA.

- Memorandum of Association (MOA) and Articles of Association (AOA): Drafting the MOA and AOA, outlining objectives and rules, is crucial. These documents must align with the charitable nature of the organization and comply with legal requirements.

- Application for Name Reservation: Submitting an application to the Registrar of Companies (RoC) for name reservation is the next step. Once approved, the chosen name is reserved for a period of 20 days.

- Filing for Incorporation: With the name reservation in hand, founders can file incorporation documents, including the MOA, AOA, and other necessary declarations, with the RoC. Adhering to the prescribed format and submitting accurate information is imperative.

- Issuance of Certificate of Incorporation: Upon successful scrutiny of the documents, the RoC issues the Certificate of Incorporation. This certificate signifies the official formation of the Section 8 Company and grants it legal recognition.

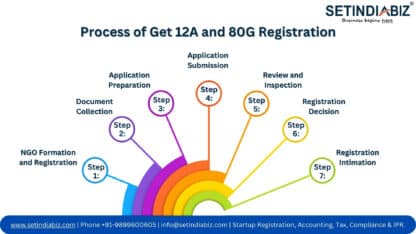

- Application for 12A and 80G Registration: To avail tax exemptions, the Section 8 Company must apply for registration under Section 12A and Section 80G of the Income Tax Act. This involves submitting relevant documents and information to the Income Tax Department.

- Commencement of Operations: Once the Certificate of Incorporation is obtained, the Section 8 Company can commence operations in alignment with its charitable objectives. Maintaining compliance with ongoing regulatory requirements is essential.

Overview

- Category: Business / Startup Consultation Services

- 32 views

- Add to Favourites

- Report Abuse

-

Share this Ad:

Seller Information

Please login to view the seller information.

Location

Related Ads

Registrare Un Nome – Ufficiobrevettimarchi

- 6 hours ago

- Italy

- 3 Views

Company Registration in Riyadh KSA

- 5 days ago

- Saudi Arabia

- 11 Views

Apply For Udyam Registration – Udyam-Register.org

- 5 days ago

- Kathua City, Jammu & Kashmir, India

- 20 Views

Explore Hassle-Free Migration to Shopify

- 5 days ago

- Mumbai - Bandra, Maharashtra, India

- 12 Views

Apply For Fssai License Here – FoodLicenceApply.com

- 5 days ago

- Chandigarh City, Chandigarh, India

- 13 Views

Cloud Contact Centre Solutions Centre

- 1 week ago

- Australia

- 12 Views

Expert Cashflow Management Advice in Sydney

- 2 weeks ago

- Australia

- 13 Views

Digital Signature Certificate in Delhi

- 4 weeks ago

- Laxmi Nagar, Delhi, India

- 22 Views

ISO Certification Consultants

- 4 weeks ago

- Netherlands

- 26 Views

Axiom Business Strategy

- 1 month ago

- Connecticut, USA

- 24 Views

RIOS Recycling Certification | MG Environmental Consulting

- 2 months ago

- California, USA

- 30 Views

Company Formation in Qatar

- 2 months ago

- Qatar

- 32 Views

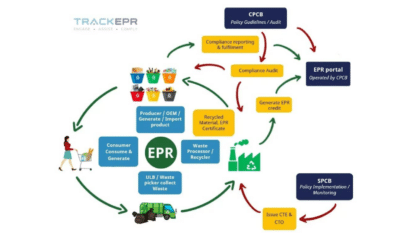

EPR Certificate in Kolkata | TrackEPR

- 2 months ago

- Delhi Cantonment, Delhi, India

- 25 Views

Startup India Registration

- 2 months ago

- Noida City, Uttar Pradesh, India

- 38 Views

Nidhi Company Registration

- 2 months ago

- Noida City, Uttar Pradesh, India

- 37 Views

Trademark Registration Online in Pune | Startup Portal

- 2 months ago

- Pune City, Maharashtra, India

- 24 Views

Business Setup Service in Riyadh KSA

- 2 months ago

- Oman

- 21 Views

Expert Financial Planning Advisor Sydney

- 2 months ago

- Australia

- 24 Views

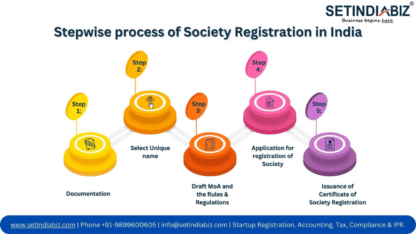

Online Society Registration with Setindiabiz

- 2 months ago

- Noida City, Uttar Pradesh, India

- 24 Views

Market Research Company in Muscat

- 2 months ago

- Oman

- 29 Views

FSSAI Registration Process with Setindiabiz

- 2 months ago

- Noida City, Uttar Pradesh, India

- 33 Views

Shaping Stories – Dr. Amit Nagpal Storytelling Coaching Principles

- 2 months ago

- Andrews Ganj, Delhi, India

- 26 Views

Online CSR-1 Registration with Setindiabiz

- 3 months ago

- Noida City, Uttar Pradesh, India

- 45 Views

The Ultimate Guide To Becoming An Odoo Consultant | Browsinfo

- 3 months ago

- Ahmadabad City, Gujarat, India

- 21 Views

Amazon Business Consultant | Yogesh Deshmukh

- 3 months ago

- Pune City, Maharashtra, India

- 26 Views

Independent Director IQ – Boost Your Knowledge with Dr. Amit Nagpal Expertise

- 3 months ago

- Friends Colony, Delhi, India

- 24 Views

Looking For a Professional Business Plan?

- 3 months ago

- Connecticut, USA

- 30 Views

Business Tax Preparation Services in California

- 3 months ago

- California, USA

- 50 Views

Unlock Growth with SME Consultants on SolutionBuggy

- 4 months ago

- Bengaluru - HBR Layout, Karnataka, India

- 82 Views

Business Consultants and Trainers in Maharashtra

- 4 months ago

- Pune City, Maharashtra, India

- 30 Views

Top Business Consultant and Trainer in Pune

- 4 months ago

- Pune City, Maharashtra, India

- 24 Views

Top Business Consultant in Pune – Business Problem Solutions

- 4 months ago

- Pune City, Maharashtra, India

- 35 Views

BEE Registration Certificate and Star Rating Service in India

- 4 months ago

- Laxmi Nagar, Delhi, India

- 34 Views

Best Entrepreneurs in India | Dr. Kuiljeit

- 4 months ago

- Mumbai - Borivali, Maharashtra, India

- 42 Views

Expert Consultants For Food Safety and Quality

- 4 months ago

- Bengaluru - HBR Layout, Karnataka, India

- 34 Views

Maximize Global Trade Opportunities and Tax Relief Through The SEIS Scheme

- 4 months ago

- Delhi Cantonment, Delhi, India

- 45 Views

ISO 27701 Consulting Service

- 4 months ago

- Bengaluru - Agara, Karnataka, India

- 125 Views

Elevate Your Brand with HM Luxury Consultancy’s Branding Services

- 4 months ago

- Gurgaon (Gurugram) City, Haryana, India

- 27 Views

Company Registration Service in Riyadh KSA

- 4 months ago

- Saudi Arabia

- 40 Views

How Grow Small Business | Business Mastery Pro

- 4 months ago

- Pune City, Maharashtra, India

- 43 Views

Business Consultant and Trainer | Business Strategy | BusinessMasteryPro.in

- 5 months ago

- Pune City, Maharashtra, India

- 29 Views

Top Food Formulation Consultants in India | SolutionBuggy

- 5 months ago

- Bengaluru - HSR Layout, Karnataka, India

- 71 Views

Outsourced CFO and Finance Services For Startups | Early Growth

- 5 months ago

- California, USA

- 51 Views

Golden Visa and Company Registration Service in Muscat Oman | BlackSwan

- 5 months ago

- Oman

- 69 Views

Business Setup Service and Company Registration Service in Muscat Oman | BlackSwan

- 5 months ago

- Oman

- 243 Views

Boost Your Business with Expert Food Consultant | Solution Buggy

- 5 months ago

- Bengaluru - HSR Layout, Karnataka, India

- 46 Views

Company Registration Service in Riyadh Saudi Arabia | Black Swan

- 5 months ago

- UAE

- 37 Views

GeM Registration For Business | Delhi eTenders

- 5 months ago

- Delhi Cantonment, Delhi, India

- 98 Views

Company Formation Services in Dubai | Golden Services LLC

- 5 months ago

- UAE

- 83 Views

Company Formation in Dubai | Golden Services LLC

- 5 months ago

- UAE

- 68 Views

Startup Dreams, Legal Ease – Your Entity Formation Solution | BusinessRocket

- 5 months ago

- California, USA

- 139 Views

Incorporate Offshore in Cook Islands | Eurofinanzza

- 6 months ago

- Washington, USA

- 91 Views

Setup Your Business in Dubai | IBR Group

- 6 months ago

- Lucknow City, Uttar Pradesh, India

- 65 Views

ISO 9001 Consultant in Somalia | B2BCert

- 6 months ago

- Somalia

- 85 Views

Best DSC Services in India | Zenith Finserv

- 6 months ago

- Rajendra Nagar, Delhi, India

- 64 Views

Buy DGFT Digital Signature Certificate From Digital Signature Mart

- 6 months ago

- Delhi Cantonment, Delhi, India

- 68 Views

How to Private Limited Company Registration | Kaushikii

- 6 months ago

- Bengaluru - BTM Layout, Karnataka, India

- 68 Views

Private Company Registration in Delhi | Sikaria Tech

- 7 months ago

- Laxmi Nagar, Delhi, India

- 73 Views

Global Marketing Strategy | Dr. Vikas Kumar Singh

- 7 months ago

- Gurgaon (Gurugram) City, Haryana, India

- 91 Views

Dubai Mainland and Freezone Company Registration Service | Black Swan

- 7 months ago

- Bahrain

- 61 Views

Online LLP Registration in Bangalore | Smartcorp

- 7 months ago

- Bengaluru - Banaswadi, Karnataka, India

- 65 Views

ISO 14001 Certification in Iraq | B2BCERT

- 7 months ago

- Iraq

- 45 Views

Private Limited Company Registration in Hyderabad | Shoplegal

- 7 months ago

- Hyderabad - Secunderabad, Telangana, India

- 58 Views

Company Incorporation in Dubai | IBR Group

- 7 months ago

- UAE

- 80 Views

Master Data Management | Dun and Bradstreet

- 7 months ago

- Egypt

- 72 Views

Private Limited Company Registration in Coimbatore | Smartcorp

- 8 months ago

- Coimbatore South, Tamil Nadu, India

- 61 Views

Digital Signature Certificate Services in Nagpur | Swara IT

- 8 months ago

- Nagpur (Urban), Maharashtra, India

- 61 Views

How to Make Money Online For Students From MySnapHub.com

- 8 months ago

- Bengaluru - Agara, Karnataka, India

- 52 Views

Online Patent Registration in India | Legalipr

- 8 months ago

- Itarsi, Madhya Pradesh, India

- 74 Views

New Business Set Up and Visa Services in UAE | Taqweet Transaction

- 8 months ago

- UAE

- 114 Views

How to Make Money Online as a Teenager – Utilizing MySnapHub.com

- 9 months ago

- Bengaluru - Agara, Karnataka, India

- 41 Views

Business Setup in Oman | Insijam Business Consultancy

- 9 months ago

- Oman

- 108 Views

Business Consulting Services in Hyderabad India | Venexture

- 9 months ago

- Hyderabad - KPHB, Telangana, India

- 63 Views

Set Up Your Jute Bags Manufacturing Unit Worldwide

- 9 months ago

- Kolkata - Barabazar, West Bengal, India

- 72 Views

Apply For Udyog Aadhar Certificate at Affordable Price | Eudyam.org

- 10 months ago

- Patiala City, Punjab, India

- 68 Views

New Business Setup and Visa Services in Abu Dhabi | Taqweet Transaction

- 10 months ago

- UAE

- 55 Views

EPR For Plastic Waste Registration with BR Associates

- 10 months ago

- Mayur Vihar, Delhi, India

- 85 Views

Startup Valuation Services in Bangalore | My Valuation

- 10 months ago

- Bengaluru - Bannerghatta Road, Karnataka, India

- 67 Views

Trademark Registration For Brands in India Very Quickly | Tax Filling India

- 10 months ago

- Hyderabad - Yousufguda, Telangana, India

- 60 Views

Business Setup and Company Registration Service in Muscat Oman | BlackSwan

- 10 months ago

- Delhi Cantonment, Delhi, India

- 64 Views

Company Registration and Business Setup Service in Dubai | Blackswan

- 10 months ago

- UAE

- 58 Views

GEM Registration Services For Businesses in Delhi | DelhieTenders.com

- 10 months ago

- Ahmadabad City, Gujarat, India

- 55 Views

Apply For MSME Registration at Msmeregistrar.org

- 11 months ago

- Jamshedpur, Jharkhand, India

- 91 Views

The Billionaire’s BluePrint By Dr. Vivek Bindra | BadaBusiness.com

- 11 months ago

- Bathinda City, Punjab, India

- 173 Views

PRO, Company Registration & Visa Services in Dubai UAE | Blackswan

- 11 months ago

- Delhi Cantonment, Delhi, India

- 63 Views

Best Digital Signature Company In Faridabad | Make My Digital Signature

- 11 months ago

- Fatehabad City, Haryana, India

- 77 Views

Business Setup Service in Dubai UAE | BlackSwan

- 11 months ago

- Mumbai - Aare, Maharashtra, India

- 56 Views

Apply For GST Registration

- 11 months ago

- Ashok Vihar, Delhi, India

- 71 Views

GEM Registration Services in Ahmedabad

- 11 months ago

- Ahmadabad City, Gujarat, India

- 64 Views

NGO Partnership Registration | Unique NGO Consultancy

- 11 months ago

- Gole Market, Delhi, India

- 50 Views

NGO Registration Process | NgoConsultancy.in

- 11 months ago

- Patparganj, Delhi, India

- 66 Views

Company Registration & Business Setup in Muscat, Oman | Blackswan

- 12 months ago

- Oman

- 109 Views

Submit Udyam Registration Application @ MsmeRegistrar.org

- 12 months ago

- Chandigarh City, Chandigarh, India

- 67 Views

Apply For Udyog Aadhar Registration

- 12 months ago

- Jamshedpur, Jharkhand, India

- 71 Views

Apply For MSME Registration | Msmeregistrar.org

- 12 months ago

- Jamshedpur, Jharkhand, India

- 78 Views

GST Registration With GSTN Registration

- 12 months ago

- Noida City, Uttar Pradesh, India

- 50 Views

ISO 9001 Consulting Services | Azpirantz

- 12 months ago

- Bengaluru - Agara, Karnataka, India

- 67 Views

Best Startup Business Solutions Provider in India | WorkerMan

- 12 months ago

- Nehru Place, Delhi, India

- 74 Views

How to Register For a DUNS Number in UAE | Dun & Bradstreet

- 1 year ago

- UAE

- 913 Views

How To Do MSME Registration in India | Contract Bazar

- 1 year ago

- Noida City, Uttar Pradesh, India

- 62 Views

Expert Enterprise Risk Management Services: Protect Your Business Today!

- 1 year ago

- UAE

- 61 Views

Digital Signature Certificate Agency in Chennai | MAKE MY DIGITAL SIGNATURE

- 1 year ago

- Chennai - Adyar, Tamil Nadu, India

- 75 Views

Company Registration Services in Dubai Mainland & Freezone | Blackswan

- 1 year ago

- UAE

- 65 Views

Digital Signature Certificate Service Providers in Faridabad | Buy DSC Delhi

- 1 year ago

- Faridabad City, Haryana, India

- 98 Views

Digital Signature Certificate Provider in Noida | Dsc7

- 1 year ago

- Noida City, Uttar Pradesh, India

- 68 Views

Online Class 3 Digital Signature Certificate | Digital Signature Mart

- 1 year ago

- Gurgaon (Gurugram) City, Haryana, India

- 92 Views

Brand Naming in London | Unboxfame

- 1 year ago

- California, USA

- 65 Views

Company Registration Service in Muscat, Oman | BlackSwan

- 1 year ago

- Mumbai - Mumbai Central, Maharashtra, India

- 82 Views

Apply For ISO Certification Online in India | FilingLounge.com

- 1 year ago

- Jamshedpur, Jharkhand, India

- 78 Views

Online Udyam Registration | UdyamRegistration.co

- 1 year ago

- Jamshedpur, Jharkhand, India

- 98 Views

Find Top Experts Business Setup Consultants in Dubai | DcciInfo.ae

- 1 year ago

- UAE

- 89 Views

Conveyancing & Corporate Services in Dubai, UAE | STF Chamber

- 1 year ago

- UAE

- 93 Views

Digital Signature Certificate Services in India

- 1 year ago

- Laxmi Nagar, Delhi, India

- 237 Views

Expert Company Secretarial Services For Business | CRO

- 1 year ago

- UK

- 76 Views

Company Registration Service in Dubai | BlackSwan

- 1 year ago

- Mumbai - Kamathipura, Maharashtra, India

- 92 Views

Best Digital Signature Provider in Noida | Buy DSC Delhi

- 1 year ago

- Delhi Cantonment, Delhi, India

- 108 Views

Renewal or Updating Digital Signature Certificate From Buydscdelhi.com

- 1 year ago

- Delhi Cantonment, Delhi, India

- 97 Views

Top-Rated Board Appraisals and Reviews For Optimal Governance

- 1 year ago

- UK

- 122 Views

Get FSSAI License for your Food Business

- 1 year ago

- Ghaziabad City, Uttar Pradesh, India

- 117 Views

Company Registration Online | SmartAuditor

- 1 year ago

- Chennai - T. Nagar (Thyagaraya Nagar), Tamil Nadu, India

- 112 Views

Trademark Registration in Pune | Alonika.in

- 1 year ago

- Pune City, Maharashtra, India

- 115 Views

Top Food Consultants in India | SolutionBuggy

- 1 year ago

- Bengaluru - HSR Layout, Karnataka, India

- 120 Views

Risk Management For Enterprises | D&B Egypt

- 1 year ago

- Egypt

- 302 Views

Apply FSSAI / FoSCoS Food License Registration

- 1 year ago

- Kolkata - Salt Lake City, West Bengal, India

- 101 Views

Numéro Enregistrement FDA

- 1 year ago

- Canada

- 90 Views

Start Your Own Start-up with us | StartupPortal.in

- 1 year ago

- Pune City, Maharashtra, India

- 92 Views

Best ESG Reporting & ESG Sustainability Services

- 1 year ago

- Noida City, Uttar Pradesh, India

- 92 Views

Why Prioritise ESG in Todays Volatile World

- 1 year ago

- UK

- 91 Views

Pharmacovigilance Service Providers in India

- 1 year ago

- Noida City, Uttar Pradesh, India

- 148 Views

Highest Quality QPPV Services at Reasonable Prices

- 1 year ago

- Noida City, Uttar Pradesh, India

- 144 Views

Renueve Su Registro FDA Con ITB HOLDINGS LLC

- 1 year ago

- Spain

- 106 Views

FDA Registrierung Erneuern | ITB HOLDINGS LLC

- 1 year ago

- Germany

- 111 Views

Best Key Account Consultant – ScoVelo Consulting

- 2 years ago

- Chennai - Nandanam, Tamil Nadu, India

- 147 Views

Get FDA Registration For Medical Device Establishment in USA | ITB HOLDINGS LLC

- 2 years ago

- Denmark

- 113 Views

Best Customer Service Outsourcing in India | Cegura Technologies

- 2 years ago

- Kolkata - Park Street, West Bengal, India

- 111 Views

Enregistrement FDA Renouvellement

- 2 years ago

- France

- 97 Views

Self Defense Training & OD Consulting in Chennai | Hale Human Capital

- 2 years ago

- Chennai - Velachery, Tamil Nadu

- 153 Views

OPC Registration in Bangalore | Smartcorp

- 2 years ago

- Bengaluru East, Karnataka

- 161 Views

Private Limited Company Registration in Bangalore | Earnlogic

- 2 years ago

- Bengaluru East, Karnataka

- 111 Views

LLP Registration in Chennai | Earnlogic

- 2 years ago

- Chennai - Maduravoyal, Tamil Nadu

- 139 Views

Top International Business Consultant | Viraj Patil

- 2 years ago

- Indore City, Madhya Pradesh

- 136 Views

Best International Business Consultant in India | Viraj Patil

- 2 years ago

- Indore City, Madhya Pradesh

- 118 Views

New Product Design & Development Services in Chennai | SolidPro ES

- 2 years ago

- Chennai - Guindy, Tamil Nadu

- 161 Views

Best Social Media Management Company in Hyderabad | Digitalz Pro Media

- 2 years ago

- Kakinada, Andhra Pradesh

- 142 Views

Bulk Buyers in India

- 2 years ago

- Bilari, Uttar Pradesh

- 163 Views

Private Limited Company Registration in Pune

- 2 years ago

- Pune City, Maharashtra

- 202 Views

Top NEBOSH Institute in Kerala

- 2 years ago

- Ernakulam City, Kerala

- 267 Views

Startup Consultant in India – Manas Khatri

- 2 years ago

- Lucknow City, Uttar Pradesh

- 234 Views

You must be logged in to post a review.